Abigail Fletcher, director of economic development at Greater Louisville, Inc. (GLI), and Sierra Enlow, managing partner of economic development at Cornerstone Strategies and a consultant for GLI, presented “Tax Incentives 101” to the Spencer County Fiscal Court in Taylorsville, Kentucky. As the manager of the Greater Louisville Partnership, GLI’s economic development team works to deliver customized support to all local community partners to maximize economic growth in the region. The presentation marks the continuation of GLI’s work to support Spencer County’s business attraction and expansion efforts and showcases a new GLP benefit to educate local government stakeholders on the latest opportunities for tax incentives as an economic development tool.

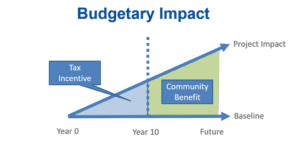

The meeting was attended by leadership of the Spencer County Fiscal Court and other government agencies, as well as staff from the Kentuckiana Regional Planning & Development Agency (KIPDA). During the presentation, Enlow discussed various tax incentives at the state and local levels, including payroll, sales, corporate income tax, insurance tax premium, and property tax—both real and personal. Additionally, she highlighted the differences between industrial revenue bonds, tax increment financing (TIF), and insurance premium taxes, along with examples of each in communities across Kentucky. Fiscal court members had the opportunity to discuss and consider the types of incentives they might offer a business contemplating locating within the community.

The presentation also emphasized the importance of selecting criteria for job types, benefits, and community values when determining which projects to incentivize. Enlow underlined the need for local participation and coordination to unlock state dollars.

Fletcher and Enlow discussed strategies for promoting economic growth, including applying for the upcoming Kentucky Product Development Initiative (KPDI) program round. The KPDI program gives Kentucky communities opportunities to seek funding assistance for transformative site and infrastructure improvements projects, which could include acquiring property, completing due diligence, and other site readiness preparations to attract a future economic development project.

The “Tax Incentives 101” PowerPoint presentation is available for download here.

The Special Fiscal Court Meeting Summary is available for download here.

If you are interested in GLP coming to speak to your community leaders on this topic or other economic development topics, please reach out to director of economic development, Abigail Fletcher.